michigan gas tax rate

Recent historical sales tax prepayment rates for gasoline and diesel fuel as applicable are set forth below. Diesel Fuel 263 per gallon.

How Long Has It Been Since Your State Raised Its Gas Tax Itep

That includes a roughly 1.

. The same three taxes are included in the retail price on. Gasoline 263 per gallon. What is Michigans gas tax now.

26 rows Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale. For fuel purchased January 1 2017 and through December 31 2021. Counties and cities are not allowed to collect local sales taxes.

Per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. The user-pays principle the idea that the people who use transportation infrastructure should fund it through paying taxes justifies such a scheme. MiMATS users should continue to use the MiMATS eServices portal.

State Senate Democrats. How a rate review works. Motor Fuel Tax The state of Michigan imposes a 19-cent per gallon excise tax on gasoline used in motor vehicles.

It will remain in place until at least the end of the year. 66 of gross cash market value. Gas Natural Gas Liquids Condensate.

The Michigan state sales tax rate is 6 and the average MI sales tax after local surtaxes is 6. Call center services are available from 800am to 445PM Monday Friday. 4 of gross cash market value.

52 rows The current federal motor fuel tax rates are. Increased Gasoline Tax rate to 19 cents per gallon. An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon.

Groceries and prescription drugs are exempt from the Michigan sales tax. Gasoline Diesel Fuel and Liquefied Petroleum Gas taxes recodified. Michigan drivers pay 42 cents per gallon in state gas taxes.

Gretchen Whitmer wants Congress to slash the federal gas tax and supports rolling back the states 6 sales tax on gas. Diesel Fuel 272 per gallon. Effective October 1 2020 through October 31 2020 the rate for gasoline was established at 107 cents per gallon and the rate for diesel fuel was established at 122 cents per gallon.

This rate will remain in effect through April 30 2022. The Michigan gas tax is included in the pump price at all gas stations in Michigan. Motor Fuel Tax Return filing deadlines have not changed.

The current motor fuel tax rate for diesel 15 cents per gallon has been in effect since January 1984 although between 1996 and 2002the rate under the Motor Carrier Fuel Tax Act was 21 cents per gallon with a 6-cent-per-gallon credit given for in -state purchases. Michigans maximum marginal income tax rate is the 1st highest in the United States ranking directly below Michigans. Unlike the Federal Income Tax Michigans state income tax does not provide couples filing jointly with expanded income tax brackets.

The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. This tax is established in the Motor Fuel Tax Act 2000 PA 403. Alternative Fuel which includes LPG 263 per gallon.

Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022. Giacomo Santangelo senior lecturer of economics at Fordham University told ABC News the nations rising gas prices are caused by a number of factors outside of the control of the states including the global supply chain. For general questions please email TreasMotFuelmichigangov.

Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation. Michigan natural gas rates. Michigan collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Compressed Natural Gas CNG 0184 per gallon. Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

Other state leaders have said they are considering similar gas tax holidays including ones in Michigan and California. Michigans excise tax on gasoline is ranked 17 out of the 50 states. Natural gas prices as filed with the Michigan Public Service Commission.

Sales tax exemption Sales and use tax exemptions for energy used by some nonprofit and governmental organizations agricultural producers industrial processors and businesses with residential electric use. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST. Gasoline 272 per gallon.

Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers. But she opposes changes to Michigans gas tax. Information on natural gas service and rates for residential customers in Michigan.

5 of gross cash market value. Motor Fuels Taxes include the Gasoline Diesel Fuel and Liquefied Petroleum Gas and Motor Carrier Fuel. Exact tax amount may vary for different items.

Increased Motor Carriers Fuel Tax rate to 21 cents per gallon with 15 cent credit for fuel purchased in Michigan. 2022 Michigan state sales tax. These tax rates are based on.

For fuel purchased January 1 2022 and after. Effective April 1 2022 the new prepaid gasoline sales tax rate is 202 cents per gallon. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St.

U S States With Highest Gas Tax 2021 Statista

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Michigan Senate Oks 2 5 Billion Tax Cut Whitmer Calls It Irresponsible

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax

Conventional Loan Rates Conventional Mortgage Mortgage Loans Conventional Mortgage Loan

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Fiat Chrysler To Put 1 Billion Into U S Jobs And Revive Jeep Wagoneer Chrysler Fiat Michigan

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

Michigan Sales Tax Small Business Guide Truic

Michigan Gas Tax Calculator Michigan Petroleum Association

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Nationwide Gas Prices Hit All Time High Michigan Prices Nearing State Record Mlive Com

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Michigan S Gas Tax How Much Is On A Gallon Of Gas

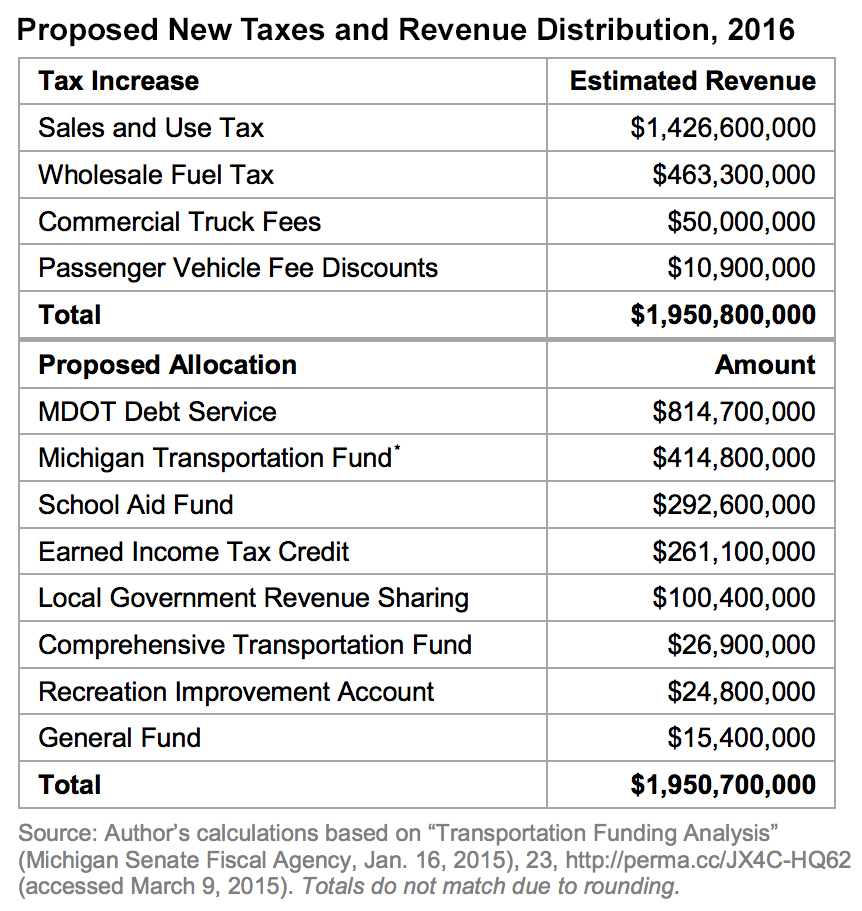

Michigan S May Tax Proposal Mackinac Center